Sorry, no search results could be found.

14 Sept 2023 | 5 minutes to read

When the Monetary Policy Committee (MPC) met in June, they agreed to raise the Bank of England (BoE) base rate from 4.50% to 5.0%. This represented the thirteenth consecutive increase, bringing it from the historic low of 0.1% up to the current level in less than 18 months.

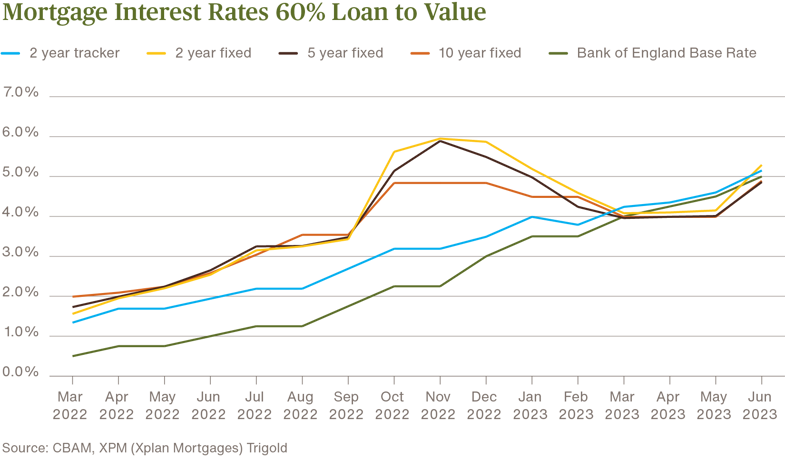

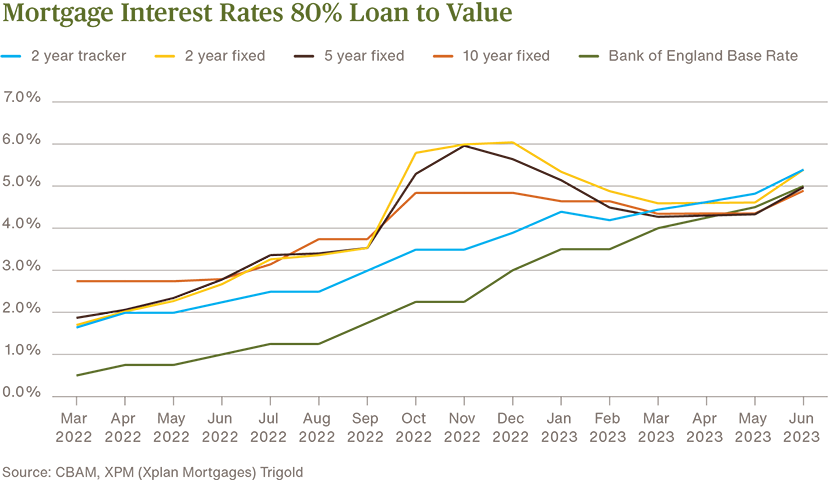

While the BoE base rate has been steadily climbing, the same is not true in relation to prevailing mortgage interest rates. Following on from the ill-fated Truss/Kwarteng government partnership last autumn, mortgage rates then declined through the spring before climbing again recently as the charts below show:

Anyone who secured their mortgage deal before September 2022 will likely have a much better rate than anything available now.

The double sized hike at the MPC June meeting surprised markets, which resulted in higher mortgage rates. Will the MPC continue to raise the base rate? Nobody can predict the future, so it is impossible to be certain. However with inflation still stubbornly high, it does appear likely that there will be further rises to come.

So what does this all mean for mortgage borrowers? Anyone who secured their mortgage deal before September 2022 will likely have a much better rate than anything available now. Some might still have a few years before their fixed rate comes to an end, while for others, that moment is looming much closer on the horizon.

There are always some important considerations to take into account when thinking about mortgages, especially if rates might be set to climb further in the future.

The re-mortgage process can potentially be complicated and time consuming, and it is important to allow sufficient time to explore all the options.

If no action is taken when your existing deal comes to an end, then you will typically revert to your lender’s standard variable rate (SVR) which is often much more expensive than the deal that is ending and also more expensive than a new fixed or variable rate deal. Inaction is therefore unlikely to be the best policy.

Your existing lender may offer the option of a new fixed or variable rate, and this is generally a simple process to follow because they have already completed all of their required underwriting at the point you first commenced the borrowing. However their deals may not be market-leading, and other lenders will potentially have more attractive rates on offer. It isn’t as simple as taking the lowest interest rate available. Rather, it is important to take account of any arrangement fees involved, along with the flexibility of the product, the duration of any tie in period, and any overpayment allowances that might be available.

When applying to a new lender, full underwriting will be required, including providing evidence of identity, earnings, and the property value. Conveyancing solicitors will also be required to complete the re-mortgage transaction from a legal perspective so time should be factored in for this too.

The best time to submit an application is around three months before the current rate is due to expire. Given all the options to consider ahead of making an application, it is prudent to begin researching around six months before your rate comes to an end.

It is an inescapable fact that interest rates are currently higher than we have become accustomed to, with many existing borrowers never having paid more than 2% for their mortgage borrowing. If your deal is coming to an end and you are concerned about the increased monthly cost, are there any options to try and keep costs down?

It might be possible to extend the full term of your mortgage, a process which reduces monthly repayments by spreading the original capital sum over a longer period of time. Most lenders are able to approve mortgage terms up to retirement (which can potentially be up to age 75 with some lenders), but is typically age 70 or before.

However, there is a significant downside to extending your mortgage term because it proves to be a lot more expensive in the long run. This is because the interest continues to be charged over a longer period of time, and it can make a significant difference to the total cost of the loan. For example, a borrower with a £200,000 repayment mortgage paying interest of 4.5% over 25 years would pay approximately £1,111 monthly. Totalling this up over the term shows that they would pay approximately £133,000 in interest alongside the repayment of the original capital sum.

If we amend the repayment term in the above example to 40 years (with all else remaining the same), the monthly repayments reduce to £900. The monthly saving of £211 may appear seductive, however the total amount of interest would increase to £231,000. Over the fullness of time the borrower would therefore face additional interest payments of more than £98,000.

The above examples are crude because they assume the mortgage interest rate remains at exactly 4.5% for the duration of the term.

In reality, borrowers will re-mortgage numerous times throughout the life of the mortgage, paying prevailing mortgage interest rates each time. It is also possible to take a longer term at the beginning of the mortgage and then to reduce it in the future should financial circumstances have sufficiently improved. For these reasons it is not always a bad idea to have a longer mortgage term, however the borrower must be aware of the implications.

Most of the fixed rate mortgage deals currently have lower interest rates than the variable ones, so this seems like a no-brainer. But what if you fix now and rates then start to come down before the tie-in period ends?

While rates are climbing and the financial markets remain volatile, many borrowers will crave the peace of mind offered by a fixed rate mortgage deal. Fixing the mortgage rate provides certainty of budget, which is especially important when other bills keep on rising.

Most of the fixed rate mortgage deals currently have lower interest rates than the variable ones, so this seems like a no-brainer. But what if you fix now and rates then start to come down before the tie-in period ends? Could you exit that deal and get a better one? Most fixed rate mortgages have early repayment charges which typically coincide with the fixed rate period. These can often be a significant sum (e.g. 5% of the mortgage balance) and careful calculations are therefore required to see if exiting to a lower interest rate deal will save money or in fact actually cost you more overall.

The right decision will always be based on a detailed analysis of personal circumstances, plans, and objectives. Fixed rate mortgages do offer certainty and peace of mind, but often lack flexibility. With so many factors to consider, it is sensible to enlist the help of a professional whole of market Mortgage Broker to help navigate through the options and ensure a fully informed decision can be reached.

Your home may be repossessed if you do not keep up with repayments on your mortgage.

You should be aware that not all buy-to-let mortgages are regulated by the Financial Conduct Authority. This means that if you choose to take up such a mortgage, you will not have the means of redress offered for regulated mortgage contracts in the event that you should have any complaints.

This article was correct at time of publishing, 12 July 2023.

Before you invest, make sure you feel comfortable with the level of risk you take. Investments aim to grow your money, but they might lose it too.